When faced with short-term financial needs, many individuals find themselves considering two primary options: loans and credit cards. Both can be valuable tools in managing financial emergencies or covering immediate expenses, but they have distinct features that can make one more suitable than the other depending on the situation. In this comparison, we will delve into the differences between loans and credit cards to help you make an informed decision based on your specific needs and financial circumstances.

Understanding Loans

A. Definition of Loans and How They Work:

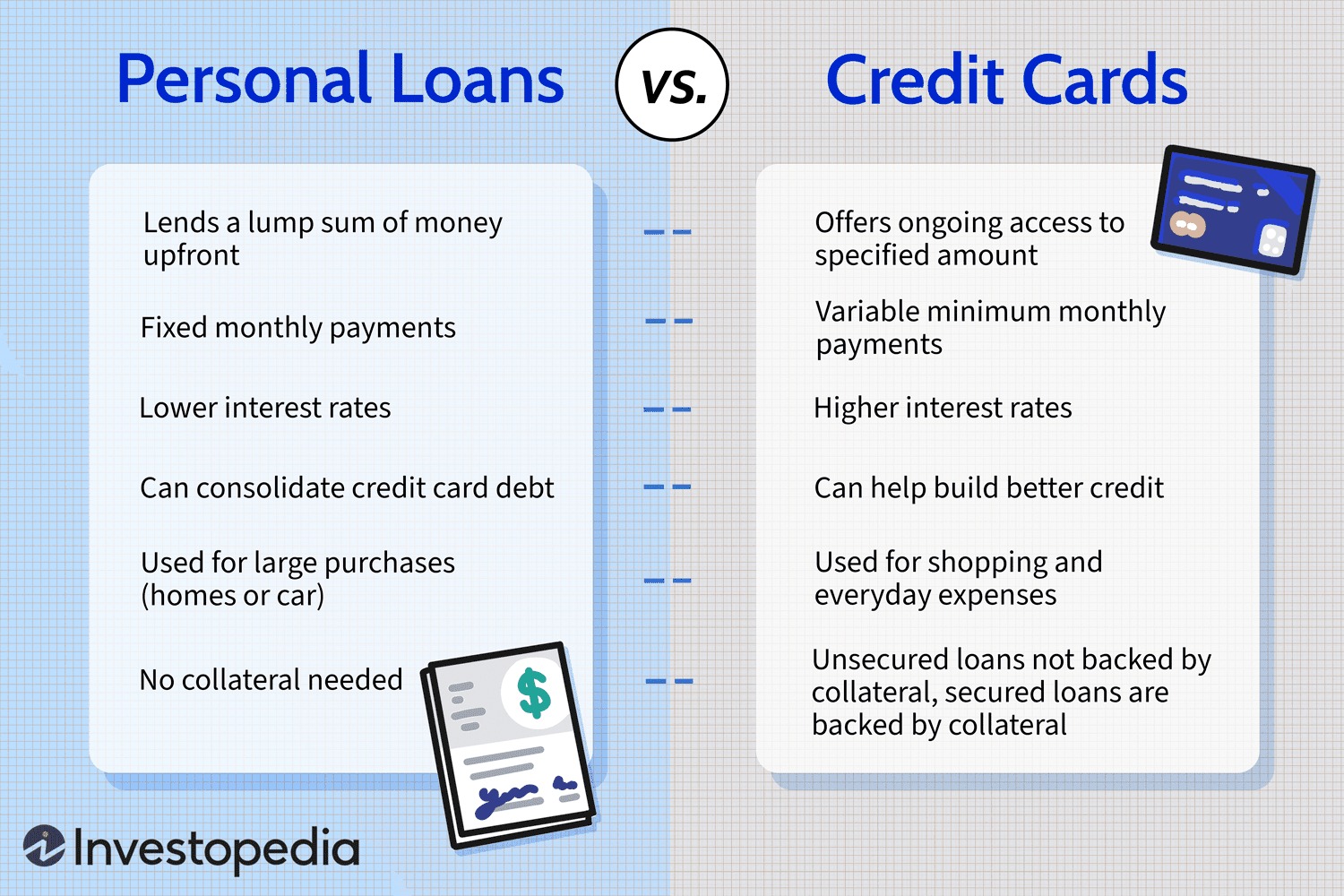

Loans are a form of borrowing in which a lender provides a specific amount of money to a borrower with the expectation that it will be repaid over time, usually with interest. The terms of the loan, including the interest rate and repayment period, are typically agreed upon before the funds are disbursed.

B. Different Types of Loans Available:

Personal Loans:

- Unsecured loans that do not require collateral.

- Typically used for various purposes, including debt consolidation, medical expenses, or home improvements.

- Fixed interest rates and fixed monthly payments for the loan duration.

Payday Loans:

- Short-term, small-dollar loans designed to cover immediate expenses until the borrower’s next paycheck.

- Often come with high interest rates and fees.

- Can lead to a cycle of debt if not repaid on time.

Line of Credit:

- A revolving credit account that allows borrowers to access funds up to a predetermined limit.

- Interest is only charged on the amount borrowed.

- Flexible repayment options, and borrowers can use and repay the funds as needed.

C. Pros and Cons of Loans for Short-term Needs:

- Advantages of Loans: a. Fixed Repayment Terms: Borrowers know exactly how much they need to repay each month, making budgeting easier. b. Lower Interest Rates (in some cases): Personal loans may offer lower interest rates compared to credit cards, depending on the borrower’s creditworthiness. c. Suitable for Larger Expenses: Loans are ideal for significant, one-time expenses that cannot be easily covered with a credit card.

- Disadvantages of Loans: a. Lengthy Application Process: Obtaining a loan may involve more paperwork and verification, leading to longer processing times. b. Potential Collateral Requirements: Some loans, such as secured loans, may require collateral, such as a home or car, to secure the loan. c. Long-term Impact on Credit Score: Missed or late payments on loans can negatively impact the borrower’s credit score, affecting future borrowing opportunities.

Understanding Credit Cards

A. Definition of Credit Cards and How They Work:

Credit cards are financial tools that allow cardholders to borrow money from a credit issuer up to a predetermined credit limit. Cardholders can use credit cards to make purchases or withdraw cash advances, and they are required to repay the borrowed amount, along with any applicable interest and fees, by the due date on the monthly billing statement.

B. Types of Credit Cards:

- Regular Credit Cards:

- Standard credit cards with a credit limit determined based on the cardholder’s creditworthiness.

- Revolving credit, meaning the available credit replenishes as the borrower pays off the outstanding balance.

- Secured Credit Cards:

- Geared towards individuals with limited credit history or poor credit scores.

- Requires a cash deposit as collateral, which often sets the credit limit.

- Rewards Credit Cards:

- Offer various incentives, such as cashback, points, or travel rewards, based on the cardholder’s spending patterns.

- Suitable for those who can manage credit responsibly and take advantage of the offered rewards.

C. Pros and Cons of Credit Cards for Short-term Needs:

- Advantages of Credit Cards: a. Quick Access to Funds: Credit cards provide instant access to a line of credit, which can be beneficial in emergencies. b. Flexible Repayment Options: Cardholders can choose to pay the minimum amount due or the full balance each month, providing some flexibility. c. Potential Rewards and Cashback Offers: Rewards cards can offer benefits like cashback, travel miles, or discounts on purchases.

- Disadvantages of Credit Cards: a. Higher Interest Rates (in many cases): Credit cards often have higher interest rates compared to certain types of loans, especially for those with lower credit scores. b. Risk of Overspending and Accumulating Debt: The ease of using credit cards can lead to impulsive spending and the accrual of high-interest debt. c. Negative Impact on Credit Score if Misused: Late payments or carrying high credit card balances can harm the cardholder’s credit score.

Determining the Best Option for Short-term Financial Needs

A. Assessing the Specific Financial Situation:

- The Amount Required:

- Evaluate the exact amount needed to cover the short-term financial need.

- Consider any additional costs, such as interest and fees, associated with the chosen option.

- The Urgency of the Need:

- Determine how quickly the funds are required.

- Assess the application and approval time for loans or credit card issuance.

- Credit Score and Financial History:

- Check your credit score and credit report to understand your creditworthiness.

- Know how your credit history may impact the interest rates and terms offered.

B. Identifying the Purpose of Borrowing:

- Emergency Expenses:

- If facing urgent and unexpected expenses, quick access to funds is crucial.

- Consider which option can provide the necessary funds promptly.

- Debt Consolidation:

- If consolidating high-interest debts, compare interest rates on loans and credit cards.

- Analyze the potential savings and the ability to manage repayments effectively.

- Major Purchases:

- For planned expenses, assess the best option based on the amount and repayment period.

- Consider the overall cost and how each option fits within your budget.

C. Considering Personal Financial Discipline and Budgeting Habits:

- Evaluate your ability to manage credit responsibly.

- Assess your budgeting habits to ensure timely repayments and avoid accumulating unnecessary debt.

D. Evaluating the Cost and Potential Risks of Each Option:

- Cost of Borrowing:

- Compare interest rates, fees, and other costs associated with loans and credit cards.

- Calculate the total amount repaid for each option to understand the true cost.

- Risks Involved:

- Consider potential risks, such as penalties for late payments or defaulting on a loan or credit card.

- Analyze the impact on credit score and future borrowing opportunities.

COnclusion

When faced with short-term financial needs, choosing between loans and credit cards requires careful consideration of various factors. Both options have their advantages and disadvantages, making it essential to assess your specific financial situation and goals before making a decision.